2023 Tax Updates

Posted: December 29, 2022

By Attorney Azene Seifoddini

Gift and Estate Tax:

The Internal Revenue Service has announced 2023 annual inflation adjustments for the annual gift tax exclusion and lifetime exemption amount. The return of high inflation will make 2023 an interesting year for tax planning.

The annual gift tax exemption, which is the amount every U.S. citizen can gift to any person tax free during a year, increased from $16,000 to $17,000.

The lifetime exemption amount, which is the amount every U.S. citizen can gift over the course of their entire life (or at death) to any person tax free, increased from $12,060,000 to $12,920,000. This $860,000 increase per donor is quite high when compared to prior years. This significant increase due to inflation creates an opportunity for additional tax free gifting for anyone who has otherwise used their exemption amount in prior years.

Keep in mind that the lifetime exemption amount is scheduled to drop to approximately $6,500,000 (which is technically $5,000,000 indexed for inflation) at the beginning of 2026, unless the law changes between now and then.

Individuals wanting to use their lifetime exemption amount before the scheduled drop should consider doing so in 2023 or 2024 to avoid the last-minute crunch that will likely occur in 2025.

Income Tax:

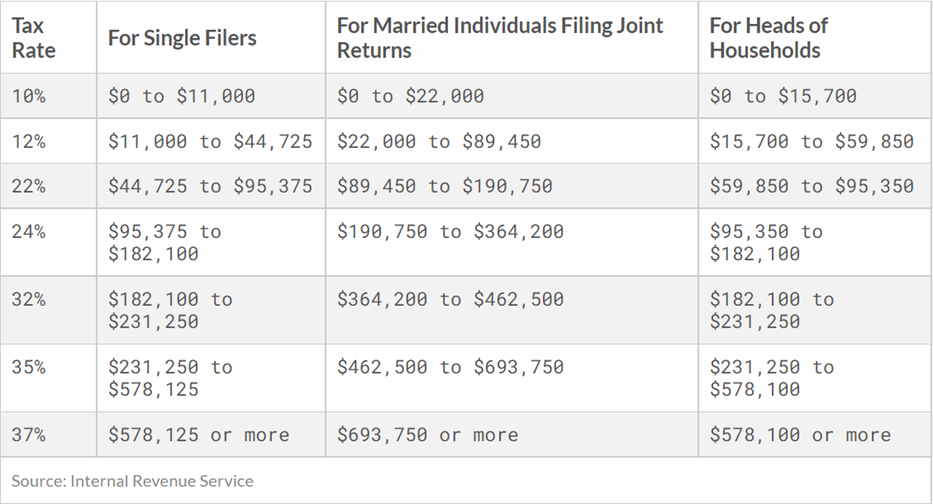

Following are 2023 income tax brackets announced by the IRS for ordinary income:

www.taxfoundation.org

www.taxfoundation.org

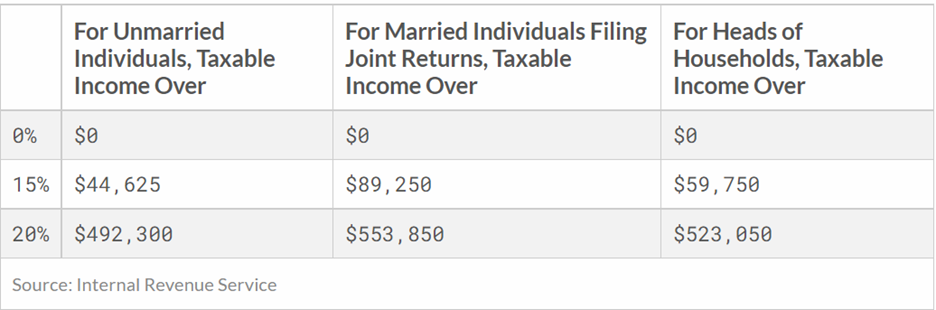

2023 long term capital gain brackets announced by the IRS are as follows:

www.taxfoundation.org

If you are interested in discussing gift, estate, or income tax issues, please contact us at (262) 238-6996 or firm@olglawoffice.com.

Schedule an appointment with us today.

Meet with a knowledgeable attorney who specializes in your area of law.

1251 W. Glen Oaks Lane, Mequon, WI 53092

F: (262) 238-6999