Preparing for Higher Interest Rates

Posted: March 20, 2021

By: Andrew J. Willms

President and CEO of The Milwaukee Company

Following its most recent meeting, the Fed made clear that it plans to do its damnedest to keep rates from rising until the “economy substantially improves.” The bond market doesn’t seem to be listening.

Yields on 10-year Treasury Notes, which affect long-term borrowing costs for businesses and households, have surged in recent weeks to the highest level since February 2020. Correspondingly, rates on 30-year mortgages rose above 3% this month for the first time since July.

Despite the recent increases in rates, there’s probably more to come. A key reason: the economic outlook continues to improve. As a result, it’s an excellent time to consider how higher rates can affect your estate plan and your investments.

Estate Planning

President Biden and many of his Democratic colleagues in Congress have pledged to significantly reduce the amount that can be transferred to family and friends tax free by gift or inheritance.

Low interest rates create an excellent opportunity to lessen, or even eliminate the taxes imposed on gifts and inheritances. That’s because the so-called 7520 rates, which are the rates the IRS uses to calculate the value of certain types of gifts and bequests, are tied to rates being paid on Treasury Bills and Treasury Notes when the transfer occurs. As a result, when Treasury rates are low, so are 7520 rates.

The simplest way to take advantage of low 7520 rates is to loan cash or other assets to family members or other individuals. Returns generated on whatever is lent in excess of the 7520 rates accrue to the benefit of the borrower are not subject to gift taxes and are kept out of the estate of the lender. Moreover, if the loan is made to a trust rather than an individual, the asset lent and the return it generates can be sheltered from creditor claims.

A more sophisticated tool that can be used to lower transfer taxes is the grantor retained annuity trust, or GRAT. A GRAT is an irrevocable trust which provides that the person who establishes it (the Grantor) is to receive an annuity payment from the trust for a period of years. When the term is up, the Grantor’s descendants (or other individuals) become the beneficiaries.

The amount of the gift when a GRAT is established is the difference between the amount of the gift and the value of annuity. The time value of money means that the lower the interest rate when the trust is funded, the greater the value of the annuity -- and therefore the smaller the taxable gift. As a result, future investment gains in excess of the 7520 rates will pass to the GRAT’s future beneficiaries free of gift tax, provided the Grantor is living when the annuity payments end.

Investments

It’s important to understand how rising rates can impact both the fixed income and equity components on investment portfolios.

Bonds:

When interest rates rise, bond prices fall. As a result, owners of bonds will see the market value of their bonds fall as rates rise. That’s not necessarily a problem, so long as the investor holds the bond until it matures and the bond issuer does not default. In that event, the bondholder will continue to receive the interest he or she expected when they bought the bond, and the amount invested in the bond upon its maturity.

The same cannot be said about most bond exchange traded funds (ETFs). They have no maturity date, and their share prices drop as interest rates rise. For example, iShares Core U.S. Aggregate Bond ETF (symbol AGG), which has $85 billion under management, has declined by 4% already this year as of this writing. Accordingly, individual bonds may be more attractive than bond funds when interest rates are rising.

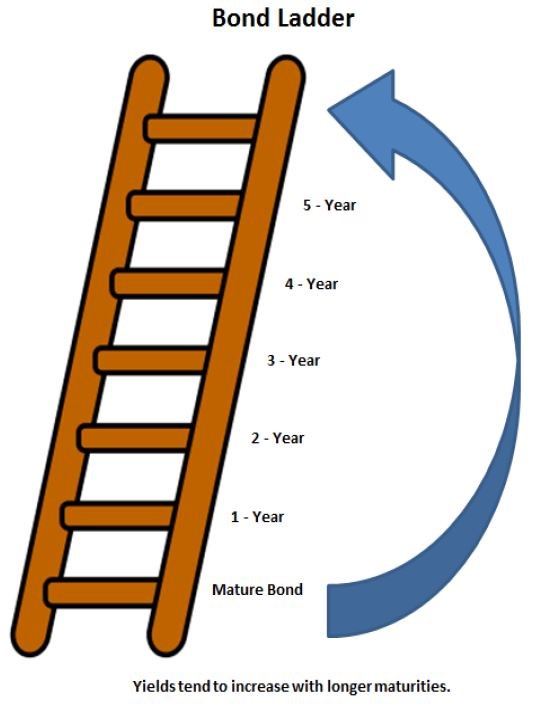

It may also make sense to invest in bonds that will mature sooner rather than later. In that case, the proceeds received at maturity can be reinvested in newer issued bonds that carry higher interest rates. Another idea is to use a "ladder strategy, where the investor buys bonds that are divided into equal parts (or “legs”) that mature in one-year intervals. When one leg of the ladder matures, the proceeds can be reinvested in new long-term, higher yielding bonds, which constitute the final wrung of the ladder.

Stocks:

Generally speaking, rising rates are a drag on the stock market. That’s because stock prices are a reflection on a corporation’s future earnings, and rising rates makes it more expensive for companies to borrow the money businesses need to grow, expand, invest, and hire new employees.

But rising rates do not impact all sectors of the stock market equally. For example, an increase in interest rates can cause stocks that have bond-like characteristics (significant, regular dividend payouts and stable prices), such as preferred stocks or utilities, to decrease in value. The opposite tends to be true for financial firms like insurance companies and banks, as those companies can achieve increased earnings in a higher rate environment as they invest in higher-yielding investments or earn a greater spread over what they pay depositors.

Rising bond yields can also make high-growth stocks look less attractive to investors by diminishing the value of their future cash flows.

Time will tell if the Fed will be able to keep interest rates lower for longer. But there seems little doubt that interest rates will eventually return to more normal levels. Given that, there’s no time like the present to prepare for that eventuality.

Thank you for reading.

Schedule an appointment with us today.

Meet with a knowledgeable attorney who specializes in your area of law.

1251 W. Glen Oaks Lane, Mequon, WI 53092

F: (262) 238-6999